Offer

ESN's approach to Research, Sales and Execution

ESN delivers a unique service through its Members in several different European location. This enables ESN to deliver a traditional full client oriented research, sales and execution service to a very large aggregate institutional client base.The first pillar of the service is each Member's in-depth local research on both blue chips and small & mid caps published as company reports, with a clear focus on companies with a market capitalisation ranging between Euro 0.5bn and Euro 5bn (Mid Caps according to the ESN Internal definition). This is complemented with the production and publication of pan-European equity sector reports, strategy reports, stock picking products and daily notes thanks to an aggregate "ESN team" of over 50 analysts covering almost 350 stocks. There is a common unique database of ESN's own universe of stocks which is one of the major internally developed assets of the partnership. The universe of stocks is then subdivided in about 20 sectors. Part of these sectors are headed by a "Sector Coordinator" who manages a team of local sector analysts and strives to select the best investment ideas within the sector at all times.

The second pillar of the service is the tailor-made sales and trading service delivered from the aggregate "ESN team" of more than 80 sales staff and traders. The ESN team cover pan-European equities and offer marketing support through seminars, road-shows and one-to-one meetings with European companies, sector coordinators and analysts.

The third pillar of the service is an advanced execution capability across all the major European markets and venues – a multi venue approach which finds its competitive advantage leveraging on the domestic expertise of each Member in its own market.

In summary, ESN's philosophy is that a client, through every local Member firm, can access a complete pan-European multi-local research, sales and execution service.

Local presence and European grip for each Member to serve clients

A local presence and team approach with the other Members is the way that each Member gathers first-hand information across Europe and passes this on to clients. A unique proprietary database which includes all the companies under coverage, collects ESN analysts' information, data and superior knowledge of their stocks and sectors giving the salespeople all the necessary support for their activity.Analysts, sales, traders and marketing people work in a coordinated way sharing documents, ideas and information as part of a unique entity, although they are employed by the Member firms.

The ESN products combine the advantage of local insight and timeliness, with the breadth of a true pan-European approach. This is especially valuable in the Small and Mid-caps arena where local proximity gives ESN a competitive edge over other pan-European options. While in the large caps arena ESN's investment ideas benefit from its insightful local understanding of economic, political, and regulatory developments within the ESN territories.

Compliance and integrity are strictly required of each of the Members of ESN. The Members have adopted for their analysts a unique "Code of Conduct" based on IOSCO and EFFAS ethical principles. Furthermore, all potential conflicts of interest amongst the Members are fully reported on the ESN website in a transparent way. All of the Members use the same standardised "absolute" recommendation system, which allows ESN analysts to rate the stocks on the basis of total return expectations and is simple and clear. Inside this system, each stock is rated on the basis of a total return, measured by the upside potential (including dividends) over a 12 months time horizon. The independency of ESN's corporate structure guarantees that the ESN investment recommendations are not tainted by conflicts of interest.

On the client side, ESN's specialist sales and trading teams provide a "tailor-made service", information and execution on a daily basis to all of ESN's clients in any European market.

ESN offers institutional clients a large and detailed programme of analyst visits, corporate road shows and seminars throughout the year, in order to bring ESN's best investment ideas to the clients. Such a large pipeline of marketing meetings helps enhance ESN's brand visibility and awareness in the market.

Equity Research

Market Coverage

ESN records a very high coverage in terms of number of local stocks and total market capitalisation in France, Italy, Spain and Portugal.Coverage segmentation

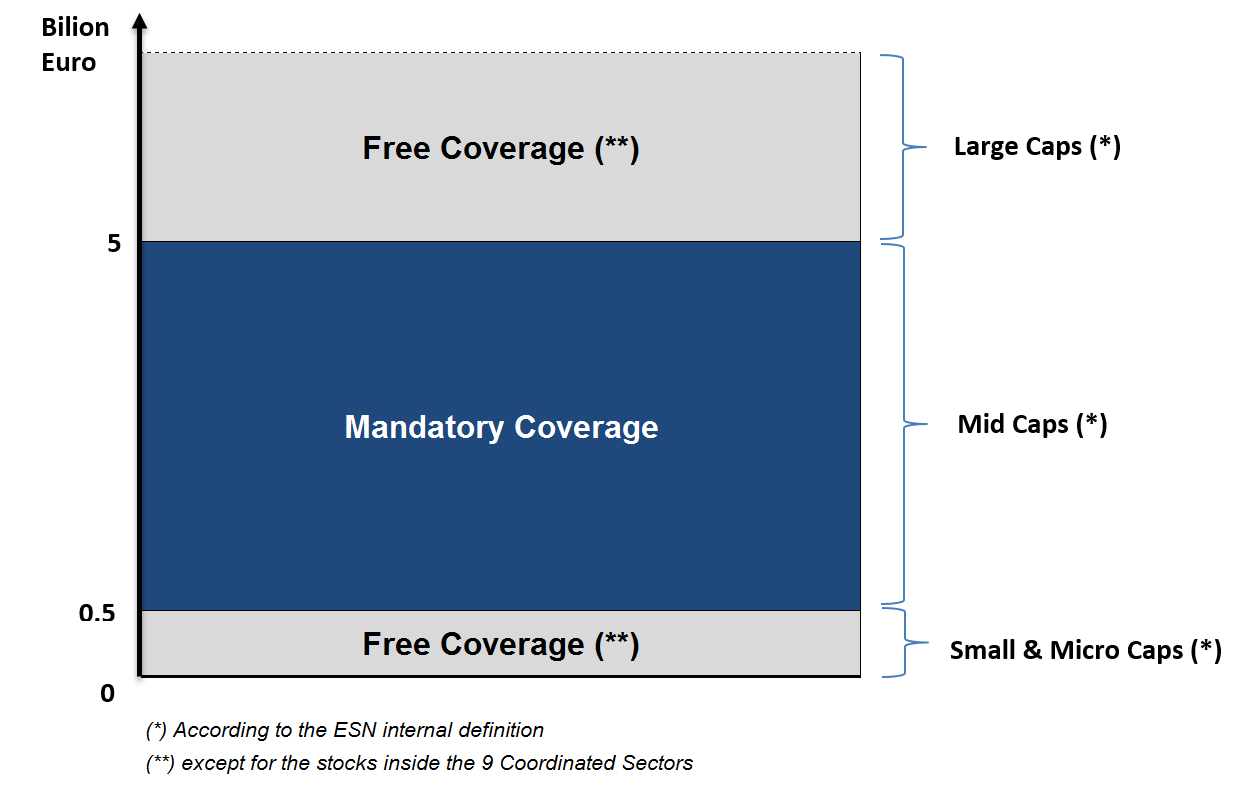

Within ESN, the research coverage is segmented to enhance the strategic contribution of each Member overall specialisation on "Mid Caps" and few selected "Sectors".- "Focus" coverage universe (mandatory for each Member). Mid Cap companies (EUR 0.5bn-5bn Mkt. Cap.) and Blue Chips of the selected Sectors.

- "Free" coverage universe (free for each Member). All other companies, mostly Small and Micro Caps, above or below the EUR 0.5-5bn Mkt. Cap. range.

Research product

In "aggregate" terms the equity teams of the Members of ESN provide one of the largest coverage in Europe with a strong positioning in the Mid & Small Caps arena.ESN has tremendous research production with more than 8,000 pieces of research produced per annum guaranteeing a continuous and active coverage of the companies included in the ESN Universe. ESN offers an extensive research selection with a wide range of local and pan-European products ranging from a daily Analyser to in-depth research on investment strategies, individual companies and sectors and strategy notes.

The overall ESN offering is a mix of local and pan-European research (local or pan-European morning notes (daily), sector notes, strategy notes, top pick ideas, etc.).

Total ESN Offer = Local Research + Pan-European Research

| Local Research | Pan-European Research |

|---|---|

| Local Morning notes (daily) | ESN Analyser (daily morning notes) |

| Company notes | ESN Stock Guides (on Blue Chips – Small & Mid Caps) |

| Local sector notes | ESN Sector Research |

| Local Macro & Strategy notes | ESN Macro & Strategy Research |

| Local Top Picks | ESN Stock Picking research (Top Picks ideas) |

| Other local research |

Main ESN Research products

- ESN Analyser (daily collection of company & sector commented news)

- Company Report (extensive research report with business and strategic analysis inside)

- Company Update

- Company Flash Notes (short report)

- Company Previews & Post Results Notes

- Long-Short Trading Idea Report

- Sector Reports

- Sector Updates

- Sector Top Picks Notes

- Sector Flash Notes

- Strategy Report

- Strategy Updates

- Strategy Flash Notes

- Macro Flash

- Stock Guide Blue Chips (semi-annual selected guide of an aggregate group of European Blue Chips companies followed locally by each Member)

- Stock Guide Mid/Small Caps (semi-annual selected guide of an aggregate group of European Mid and Small Caps companies followed locally by each Member)

- ESN Top Picks selections - Blue Chips & Mid/Small Caps (either long or short ideas. Cut off period after 6 months from the inclusion in the list).

Sector approach

Members have set clear guidelines to define the way analysts cooperate and to adopt a unique sector approach, which are followed by all analysts.Through this common sector approach, analysts of different Member firms cooperate, share information and improve their personal knowledge. Regular conference calls (on a weekly or bi-weekly basis) are organised amongst the analysts who are members of the same sector team. Sector coordinators organise at least one physical meeting per annum with all the members of their sector team with the aim of improving cooperation and enhancing personal relationships.

Specific rules of cooperation have been established between Sector coordinators and local analysts to align interests and priorities.

The analysts' coverage is subdivided into 20 macro-sectors.

Few selected sectors have been chosen to be coordinated by a "Sector Co-ordinator", who is a senior analyst acting as head of the sector team.

ESN focuses its effort on a few sectors where:

- sufficient Member coverage exists,

- local bias counts more,

- Members have the most skilled analysts.

Strategy team

The need to have a common framework for analysts, sales and clients has required the Members to create a unique team of strategists in ESN, consisting of a group of local senior macroeconomists and strategists. The work of the Strategy team is organised and managed by an ESN "Strategy Coordinator". Clear roles and division of responsibility amongst the people of this team has been designed to avoid overlaps and inconsistencies.Regular ESN strategy products are published.

They are subdivided in "building blocks" for an overall view on equity markets and sectors (see below):

- ESN Growth Monitor

- ESN Inflation/Interest Rate Monitor

- ESN Earnings Monitor

- ESN Fundamental Valuation Monitor

- ESN Sector Rotation Monitor

- ESN Semi-annual Equity Strategy

- Several "ad hoc" publications (such as ESN Macro Flash) on relevant local macro or political news (dedicated to add in-depth understanding, local flavour and local expertise to clients).

ESN Definition Guide

Sharing the same methodologies and using the same data definitions and standards have been and are still critical building blocks for ESN and represent the basis for any valuation comparison inside the large pan-European coverage of ESN.The "ESN Definition Guide" was the tool to achieve the above. It is a common definition guide to be used as a reference by all analysts containing definitions, data, ratios and general guidelines of valuation methodologies for Industrial, Bank, Insurance and Real Estate companies. It also contains some common ESN principles for the calculation of DCF (WACC, terminal growth rate and other DCF parameters).

The ESN Definition Guide has existed for more than 15 years and it is regularly revised and enriched by the local Heads of Research.

In 2011 the ESN Definition Guide was requested by the Italian Analysts Association (AIAF) to help them to create a definition guide for equity analysts. The AIAF guide was finalised in June 2012 and then was brought to EFFAS (European Federation of Financial Analysts Society) to get an European "passport". In June 2013 EFFAS approved and adopted the Guide brought by AIAF (that took as initial document of reference and main operating source the ESN Definition Guide) as European Definition for equity financial analysts.

ESN Database

One of ESN's main assets is its own proprietary Database (running on a FactSet software). The Database is an invaluable competitive tool for the Members. It is a common proprietary database, available for both analysts and salespeople, with a wide collection of company data (balance sheet items, profit & loss items, cash flows items, market multiples, peer comparison tables, etc.). One of the Database's main benefits for analysts and salespeople is the possibility of creating a personalised aggregation of data and company peers' tables ("minibases") that allow users to extract specific company items and/or compare stocks on the basis of preselected criteria/parameters (by sector, by sub-sector, by country, by region, etc.).The Database is also used as a research management tool being the main storage area for the historical research documents of all the companies covered.

The adoption of a common Database has allowed ESN and its Members to overcome certain shortcomings: for example, documents and figures found in different repositories, local databases not communicating with each other, a lack of a centralized quality control and difficulties in keeping ESN common standards and templates.

This powerful engine assists analysts in publishing research documents by way of updatable predefined templates. The Word reports interface with the Excel data set so that the user does not waste time with manual editing, but focuses simply on writing the content using predefined formats. An automatic link between the database and the research distribution platforms (e.g. Bloomberg, Thomson-Reuters, FactSet, CapitalIQ) ensures that the product is delivered to clients in a timely and fully regulation-compliant manner.

Stock Picking

The Members have created a stock picking product: the "ESN Top Picks" (which consist of two selections of single investment ideas, one for Blue Chips and one for Small & Mid Caps). The goal of this stock picking product is to show clients ESN's overall selection capability using a bottom-up and multi-local approach. Ideas can be either positive (buy/long) or negative (sell/short) and should have an interesting upside/downside potential.These selections of stocks are not intended as recommended portfolios. The performance of each stock has to be considered independently. Risk factors are taken into account when selecting individual stocks but the risk profile of the entire selection is not considered.

The product is fundamental equity research driven product and not short-term trading idea product. Every idea is supported by an "investment case" which reports the fundamental reasons behind the inclusion of the stock in the lists.

An automatic expiration (cut off period) has been fixed: 90 days; after which time the ideas are automatically removed from the lists independent of their performance, unless a case of extraordinary earlier exclusion occurs.

The Top Picks product was launched in 2004 and more than 1000 investment ideas have been presented so far.

Sales Service & Execution

Institutional Sales & Execution service

The research product is only part of what ESN offers. ESN's specialist Sales and Trading teams strive to provide clients with the best "tailor-made service", information and execution capability on a daily basis. Furthermore, the marketing support which occurs through analyst visits, corporate road shows, seminars and one-to-one meetings with European companies helps bring the best investment ideas to clients throughout the year. The characteristic nature of ESN is well recognised by each Member. The ability to not only analyse their local companies on a pan-European sectoral basis but to distribute their domestic stocks across Europe is viewed as a key differentiator for each Partner.The Members' direct presence, with sales teams in all of the Countries where ESN is present, allows ESN to be close to its clients and to cater to their needs in the clients' own languages and with a more personal approach. All of the ESN sales team is composed of "specialist" and "generalist" salespeople who have an in-depth knowledge of clients' needs and of the specific situation of the country in which they operate. The ESN sales people and traders are comprised of approx. 80 experienced professionals who carry out all of the clients' orders in the main European markets.

ESN Clients

ESN serves a very large institutional clients base in Europe. To provide the best possible service is the only way ESN has to survive in the industry. Thanks to a direct presence in several different European countries, almost all of the main local TIER 2 & TIER 3 institutional investors are catered to as well as many global TIER 1 clients."Long only", "hedge funds" & "insurances" represent approximately 76% of the ESN institutional client base. "Long only" (mutual funds & pension funds) is the largest group of ESN clients (accounting for approx. 62% of the client base) both in terms of number of clients and assets; "insurances" & "hedge funds" account for more than 14% of ESN client base, while the remaining ESN client base is spread amongst Private Banking firms and other categories of institutional investors.

ESN Morning Meeting

The ESN Morning Meeting is key to the internal cooperation that exists amongst the analysts and salespeople of the different Members and amongst ESN salespeople and analysts in general. It is held via conference call every day (all Partners connected). A coordinator has been appointed to manage the call and each contribution made. The goal of the Meeting is to share "the best" ideas from each local morning meeting and extract news with a clear impact on the market and which are relevant for non-domestic European investors. Each Member has identified a salesperson responsible for its country.A preparatory work from the salespeople attending the Meeting is needed to:

- select the best ideas of the day from local morning meetings and give the other Partners the "Local Flavour";

- comment on important local news (political, macro data, etc.);

- quote relevant research reports in issue;

- identify the analyst(s) who will participate on the call and inform (through the ESN Chat) the coordinator of the ESN Morning Meeting call.

- comment on important changes in recommendations and/or target price;

- changes in estimates;

- "corporate actions" (such as a new industrial plan, an acquisition, a big capital increase, etc.).

Distribution of Research

The direct research distribution of the whole research product is managed directly by each Member. The indirect research distribution which occurs through the major research distribution providers (Bloomberg, Thomson-Reuters, Capital IQ, FactSet) is managed centrally by ESN's staff.In order to protect the value of ESN's Research product, a strict clients' authentication process has been implemented and occurs through the main research distribution providers.

Equity Execution

ESN offers clients execution on both large caps and small & mid caps, leveraging off its presence in several European countries and markets. All Members are electronically connected via Direct Market Access and Electronic Desk Access through a common infrastructure platform. Each Member has signed a specific service level agreement with the other Members. Members' investment in trading platforms allows them to meet regulators and clients' expectations in terms of execution, offering the best execution across multiple venues with the use of SOR (Smart Order Routing) and of algorithmic applications. ESN is a natural liquidity pool in which the combination of local information is another key aspect of cooperation. Some facilitation of clients' block-crossing activity, although limited, has been introduced by several Members. a large and detailed programme of analyst visits, corporate road shows and seminars throughout the year, in order to bring ESN's best investment ideas to the clients. Such a large pipeline of marketing meetings helps enhance ESN's brand visibility and awareness in the market.Other business activities

Other business activities amongst Members (ECM - DCM - Secondary Bond Market and other businesses)

The initial cooperation among the Members of ESN in equity Research, Sales and Execution developed to include other businesses on a "non-exclusive" basis.Thanks to the level of trust and fair cooperation established amongst the Members and leveraging on the existing relationships in the core businesses, new common businesses developed in the ECM (Equity Capital Market) and, sometimes, in DCM (Debt Capital Market), secondary bond market and other businesses.

Dedicated working groups of professionals were set up with representatives from the interested Members. The people of those working groups established regular contact with each other both as a group (they organise regular conference calls and physical meetings) or bilaterally, with the aim of creating business opportunities among them.

On the primary markets specifically, ESN helped each Member to enhance its own "placing power" outside its domestic territory. Such enlarged distribution capacity, although indirectly through the other Members of ESN, helped each Member to change its profile from a purely domestic player to an innovative pan-European one.